Latest Posts

Immigration Route for an International Sportsperson: A Case Study of a Football Manager’s Visa Requirements

In the globalised world of sports, the mobility of talent is crucial. Football managers, akin to players, often find themselves working across various countries. The immigration process for a football manager involves navigating a complex web of legal requirements. This article aims to elucidate the key steps and legal prerequisites involved in obtaining a visa for an international football manager, focusing on a recent case involving Liverpool FC‘s new appointment.

Case Study: Arne Slot’s Appointment at Liverpool FC

The football community was abuzz when Liverpool FC announced that Arne Slot, the former Feyenoord boss, would succeed Jurgen Klopp as their manager. Slot’s era at Anfield is set to begin on June 1, but his appointment is contingent upon receiving a work permit from the UK government. This situation provides a practical lens through which we can examine the visa process for football managers.

Visa Categories For Sports Professionals

For a football manager seeking to work in the UK, the most relevant visa category is the “T2 Sportsperson Visa,” which has been rebranded as the “International Sportsperson Visa.” This visa is designed for elite sports professionals, including managers and coaches, who are internationally recognised and whose employment will make a significant contribution to the development of their sport at the highest level in the UK.

Key Legal Requirements

- Sponsorship by a Recognised Body:

- Governing Body Endorsement: Slot must obtain an endorsement from The Football Association (The FA), which confirms his skills and reputation as an elite sportsperson and his anticipated contribution to football in the UK.

- Certificate of Sponsorship: Liverpool FC must issue a Certificate of Sponsorship (CoS). The club must be licensed by the Home Office to issue such certificates.

- Eligibility Criteria:

- Professional Standing: Slot needs to demonstrate significant achievements, such as his successful tenure with Feyenoord and his potential impact on football in the UK.

- English Language Proficiency: Slot must meet the English language requirement, typically by passing an approved English language test or holding an academic qualification taught in English.

- Maintenance Funds: Slot must show he has sufficient funds to support himself without relying on public funds, usually having at least £1,270 in his bank account for 28 days before the application.

- Application Process:

- Online Application: The application for the International Sportsperson Visa is submitted online, including the endorsement from The FA and the Certificate of Sponsorship from Liverpool FC.

- Biometric Information: Slot must provide biometric information (fingerprints and a photograph) at a visa application centre.

- Fees: The application fee and the Immigration Health Surcharge (IHS) must be paid. The IHS grants access to the UK’s National Health Service (NHS) during his stay.

- Validity and Extensions:

- Initial Period: The International Sportsperson Visa is typically granted for up to three years.

- Extensions: Extensions can be applied for if Slot continues to meet the eligibility requirements, including having a valid Certificate of Sponsorship.

- Path to Settlement:

- Indefinite Leave to Remain (ILR): After five years in the UK on this visa, Slot may be eligible to apply for ILR, allowing him to live and work in the UK indefinitely. He must meet residency requirements and demonstrate continuous employment in his role.

How The Process Works For Arne Slot

For Slot to start working as Liverpool FC’s manager, the following steps are necessary:

- Obtaining Endorsement and Sponsorship: Slot needs an endorsement from The FA, confirming his eligibility. Liverpool FC must also secure a Certificate of Sponsorship.

- Application Timeline: Slot can apply for his visa up to three months before his start date on June 1. If he is inside the UK, a decision is typically made within three weeks; if outside, it may take up to eight weeks.

- Duration and Extension: The initial visa will last three years, with the option to extend, provided Slot’s employment conditions remain unchanged.

Likelihood of Approval

Given Liverpool FC’s announcement and the absence of any known issues in Slot’s past, it is highly likely that his visa application will be approved. The club’s confidence in announcing his appointment suggests they foresee no significant barriers in obtaining the necessary work permit.

Conclusion

The immigration route for a football manager like Arne Slot involves a meticulous process to ensure only the most qualified professionals are granted entry. By fulfilling legal requirements, such as obtaining endorsements, securing sponsorship, and meeting eligibility criteria, Slot can begin his tenure at Liverpool FC. Understanding these legal intricacies is essential for clubs and managers alike to navigate the process successfully. As international sports continue to evolve, staying informed about immigration policies will remain crucial for the seamless movement of sporting talent.

If you or your connections require legal advice, please contact Jayesh Jethwa or fill out our enquiry form below.

Saudi Arabia and Football – Alluring Yet Possibly Taxing!

Cristiano Ronaldo at the ripe age of 38 earning £170 million, who could blame him? What has followed, however, is a revolution of sorts, with dozens of top flight footballers in the peak of their careers following suit to Saudi Arabia.

Few British footballers have historically looked beyond the Premier League and yet, in almost an instant, the allure of playing football in foreign leagues has gained real traction, with Saudi Arabia emerging as the number one overseas league this summer owing to its ever-increasing global prominence and substantial salaries on offer. Forever the ones to crash the party, here comes a tax lawyer to sound the alarm. Yes, I am going to say it…the magic words ‘tax-free’ may be more taxing that you initially think.

UK Tax on Worldwide Income

To understand why, let us think about how UK tax generally operates in the context of the world of football. Even though Saudi Arabia does not charge income tax, that doesn’t mean you are totally outside the income tax net. As a starting point, if you are UK resident then you will very likely be subject to UK income tax on your worldwide income. Becoming non-UK resident can, of course, exempt our favourite footballers from UK income tax, but you have to pay close attention to the rules, really adhere to them and keep records of how you are getting on.

Taxing Player Businesses Outside Football

This is not just about employment income. As football aficionados will know, footballers derive their income from several sources, not all of which are employment related ie footballer kicks ball for club and club pays footballer money. Footballers will often generate substantial income from image rights and commercial endorsements.

What if the footballer has a company into which such income is paid and the company is UK incorporated – yes, you guessed it – ongoing exposure to UK tax. Going to Saudi Arabia, even as a non-UK tax resident is not going to eliminate all UK taxes, necessarily. Again, what if a player receives a signing bonus.

This will again come down to timing and the player will almost certainly be taxed on the basis of their UK residence at the time of receipt. So the question is how to address these structures to ensure they work tax efficiently when transfers dealings can happen, practically, overnight!

Our Conclusion

These rules can be tricky, particularly where players return after a complete season but half way through a tax year. Navigating the web of tax rules, as with any internationally mobile high-net worth individual, is essential to avoid any unwelcome surprises from the taxman back home. By keeping advised and well informed, players can rest easy and focus on the game. Who knows how long the bonanza will last, but where there is movement, there will always be tax implications!

For Private Wealth & Tax advice and services, please contact Ben Rosen via our contact form below.

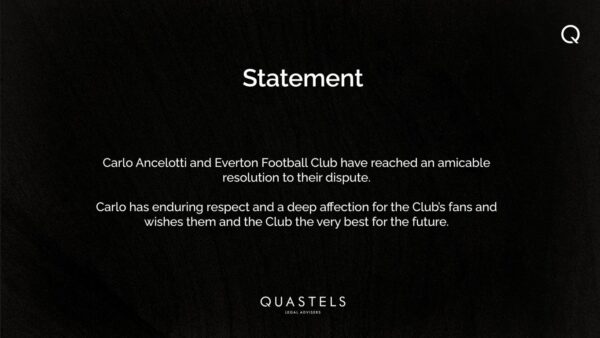

Carlo Ancelotti Everton Statement

Simon Grossobel and Daniel Blake of Quastels are authorised to publish the following statement on behalf of their client Carlo Ancelotti.

Read More