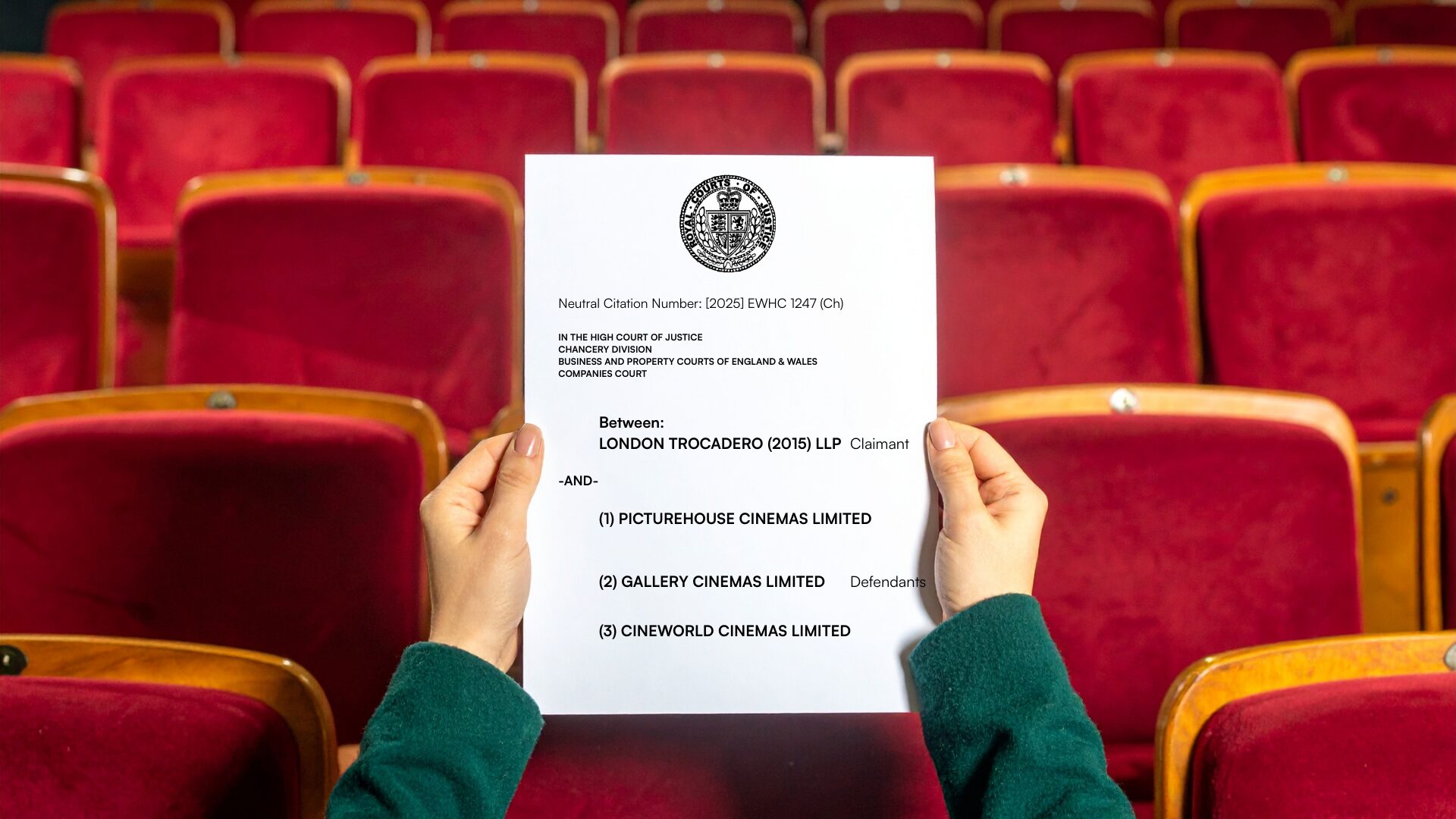

A recent ruling in Trocadero (London) Ltd v Picturehouse Cinemas Ltd & others has clarified the scope of the covenant to pay insurance rent in commercial leases with particular reference to landlord’s commission. At Quastels, we are closely following the implications of this judgment for our clients involved in commercial property leases. The decision carries significance for both landlords and tenants with potential ramifications both in terms of future drafting of leases and retrospective claims from tenants.

Background

The dispute arose out of the Landlord’s (Trocadero (London) Ltd) claim against its tenants (Picturehouse Cinemas and others), for failure to pay the annual rent and insurance rent, albeit, during COVID-19-induced closures. The Landlord’s claim for recovery of rent arrears was successful, however, the tenants brought a counterclaim questioning the level of insurance rent payable under the terms of the lease, specifically the recoverability of the Landlord’s commission. As would be expected in the vast majority of commercial leases of part, the landlord had an obligation to insure the centre in which the units were located and the tenants were obligated to pay the ‘premium’ and associated costs payable by the landlord in keeping the building insured.

In this case, the ‘premium’ charged to the Tenant, by way of insurance rent, was made up of the following:

- The actual cost of insuring the building (the net premium);

- The insurance broker’s commission; and

- The Landlord’s commission, to be recovered from the Tenant for the benefit of the Landlord.

It is worth noting that on occasions, the Landlord’s commission amounted to over 50% of the premium. The landlord’s commission was entirely optional and obtained at the Landlord’s broker’s request based on a commission sharing arrangement – with the broker retaining an amount and repaying the remainder to the landlord.

Judgment

Ultimately, the court did not find that the Landlord’s commission was contractually payable by the Tenant under the terms of the lease and, importantly, ordered that sums received from the Tenant on account of the Landlord’s commission element of the insurance rent were to be repaid to the Tenant.

What was material to the Court was that the Landlord’s commission was optional, therefore, hypothetically speaking, even if the Landlord’s commission was deemed to be payable, it would not satisfy the criteria of being payable for keeping the building insured, but rather for “providing the Landlord with an opportunity to profit at the Tenant’s expense” as Justice Richards explained. Justice Richards further commented that “the costs in question are in the nature of overheads or costs of the Landlord’s letting business which is to be paid out of the receipt of rent”, indicating that any administrative costs in Landlords arranging buildings insurance should form part of their commercial considerations or financial analysis before letting a premises.

What does this mean for you as a Landlord or a Tenant?

There is a general consensus amongst legal professionals that this ruling may act as a catalyst for commercial tenants to look more closely into any embedded commissions that could be hidden within their insurance rents, in the hopes of seeking restitutionary remedies in respect of any payments previously made.

However, landlord commission structures are commonplace in commercial buildings insurance set-ups (albeit usually at a much lower percentage than as seen in this case), and such remedies would only be afforded to tenants in the absence of clear insurance provisions in the lease. There are various conditions which must be satisfied in order for a tenant to have legitimate grounds for such a claim. It is therefore crucial that tenants seek legal advice on (1) the scope of any insurance rent, before committing to a lease and (2) provisions in existing leases if tenants consider they may have a potential claim for overpaid commission.

In terms of point (2) and potential claims, tenants should act quickly given that, as a general rule (with some exceptions), a claim under restitution is time limited to six years.

Landlords should be cautious before adopting an all-encompassing approach to cost recovery as it is now clear that the courts will be unlikely to favour the landlord and permit the recovery of landlords’ commissions where this is not expressly stated in the lease. This calls for Solicitors to work collaboratively with their landlord clients to avoid any ambiguity in the recoverability of all elements of insurance rent.

Conclusion

Trocadero v Picturehouse provides us with clear guidance that the courts expect landlords abd tenants to negotiate lease agreements critically, to avoid any disparity in the respective parties’ financial obligations. Going forwards, the standard commission fee being charged to tenants could be subject to challenge in new leases and could result in numerous successful claims for previous such payments to be recovered.

Our expert Commercial Real Estate and Property Dispute Resolution departments are here to provide both tenants and landlords with bespoke advice in relation to both the interpretation of existing leases and the possibility of claims being made for previous overpayments and the drafting of insurance provisions in future leases.