Latest Posts

Managing Toxic Behaviour in the Workplace

Toxic employees in the workplace present a unique threat to businesses. Their behaviour pervades team dynamics, undermines the authority of managers, the efficiency of business operations and the wellbeing of fellow employees.

Identifying Common Types of Toxic Behaviour

Three common types of toxic behaviour include:

- The Complainer: This employee looks to find fault in almost every situation, spreads their negative energy amongst the team and dampens team morale.

- The Narcissist: This employee has an inflated sense of self-importance, they are overconfident, lack empathy and never take accountability or responsibility often deflecting from their own underperformance by pointing out other people’s mistakes.

- The Aggravator: This type of employee belittles, humiliates and insults others. They have a tendency to spread misinformation, gaslight and manipulate others. They may exclude people from meetings and projects under the guise of professionalism and their behaviour is often targeted towards a specific or small number of individuals.

The Consequences of Inaction

When managers fail to address such conduct swiftly and visibly, they risk appearing ineffective or inconsistent, further encouraging disruptive behaviour and disempowering those in leadership roles.

The Cultural Impact of Toxicity

Toxic behaviour is also a cultural contaminant as it spreads silently through gossip, cliques, and negativity, derailing strategic priorities. Collaboration between individuals and teams suffers over time, high-performing employees may disengage or exit altogether, leaving a vacuum filled with underperformance.

Preserving Trust and Confidence

In every employment relationship, there is an implied duty of ‘mutual trust and confidence.’ When there is a lack of early management intervention to tackle disruptive behaviour, employees may feel frustration and resentment resulting in disengagement or even resignation (which may itself, give rise to a claim of constructive dismissal).

Health, Wellbeing, and Legal Risks

A failure to tackle toxic behaviour could also amount to co-workers suffering heightened stress and anxiety leading to persistent or long-term sickness absences which could amount to a breach of the duty to provide a safe working environment.

As uncomfortable as it might be, employers must act swiftly to tackle disruptive behaviour remembering to follow the ACAS code of practice, acting consistently and proportionately in each case.

Considering Mental Health and Reasonable Adjustments

Where a mental health condition or disability may be a factor in the employee’s behaviour, reasonable adjustments must be considered. However, persistent inappropriate behaviour may justify formal warnings or dismissal if it undermined organisational harmony.

Why Early Intervention Matters

Toxic behaviour erodes more than morale – it compromises authority, productivity and the retention of valuable employees. Early management of such behaviour is essential to maintain a happy and productive workforce.

This article was published in the July/August 2025 edition of London Business Matters.

Please get in touch with our Employment team via the form below.

Read More

Selling Smarter: Conveyancing Tips for a Smoother Property Sale

The process of selling your home can be stressful, but with the right approach, it does not have to be. From gaining a good understanding of what to expect to preparing key documents early, these conveyancing tips will help streamline the process, avoid delays and ensure a smoother, more efficient sale from start to finish.

Understanding the Conveyancing Process

Once you instruct your conveyancer and complete the property information forms, they send a contract pack to the buyer’s conveyancer. For leasehold properties, a management pack is also ordered which contains information on management, fees and obligations.

The buyer’s conveyancer conducts searches, surveys and may raise enquiries. Your conveyancer will help respond to these with your consultation, where appropriate.

Once all enquiries are satisfied, both parties exchange contracts and set a completion date. Exchange makes the sale legally binding.

On completion, the buyer’s conveyancer transfers funds, you vacate the property and then hand over the keys. Any existing mortgage is redeemed, and the sale proceeds are sent to you.

Document Provision and Upfront Information

Providing upfront information to your conveyancer allows them to prepare a comprehensive contract pack, identify potential issues and speed up the process.

Although property owners might not have complete records of their documents, providing as much as possible early on makes your property more appealing to buyers.

We recommend you start compiling your property documents when you list the property, to make things easier once a sale is agreed.

At the outset, you will need to provide your proof of identity and address, onboarding documents, and Land Registry Forms:

- Property Information Form (TA6) – discloses key details about the property.

- Fittings and Contents Form (TA10) – Lists items at the property to be included/excluded in the sale.

- Leasehold Information Form (TA7) – Relevant if the property is leasehold.

You should also consider if the following items are relevant to your sale:

- Your mortgage details, so your conveyancer can arrange repayment on completion.

- Newbuild home warranty (i.e. NHBC, LABC, Premier or other providers).

- Planning Permissions, consents and building regulation certificates – for alterations or major works.

- Gas Safety and Electrical Certificates – If available, especially for recent works.

- Warranties and Guarantees – For windows, boilers, etc.

- Dispute and Insurance Claim details.

- Indemnity policies taken out when you purchased the property.

If requires, complete, sign, and serve the Leaseholder Deed of Certificate promptly, as your landlord has 4 weeks to respond.

Communication with your Conveyancer

Effective communication between you and your conveyancer will ensure the smooth and swift progression of your sale. It also helps your conveyancer manage progress towards known deadlines, keeping all parties aligned.

Agree on the best way to communicate with your conveyancer early on. Email will be the primary form of communication throughout the transaction, but notify them if you wish to use alternatives, when appropriate. For example, the best way to reach you for urgent matters, or perhaps you would like time-sensitive updates via WhatsApp.

Quick, clear contact helps resolve issues faster, reduces stress, and lowers the risk of delays or the sale falling through.

Following these conveyancing tips will help ensure a smooth sale. For more information, please contact our Residential Real Estate team via the form below.

Read More

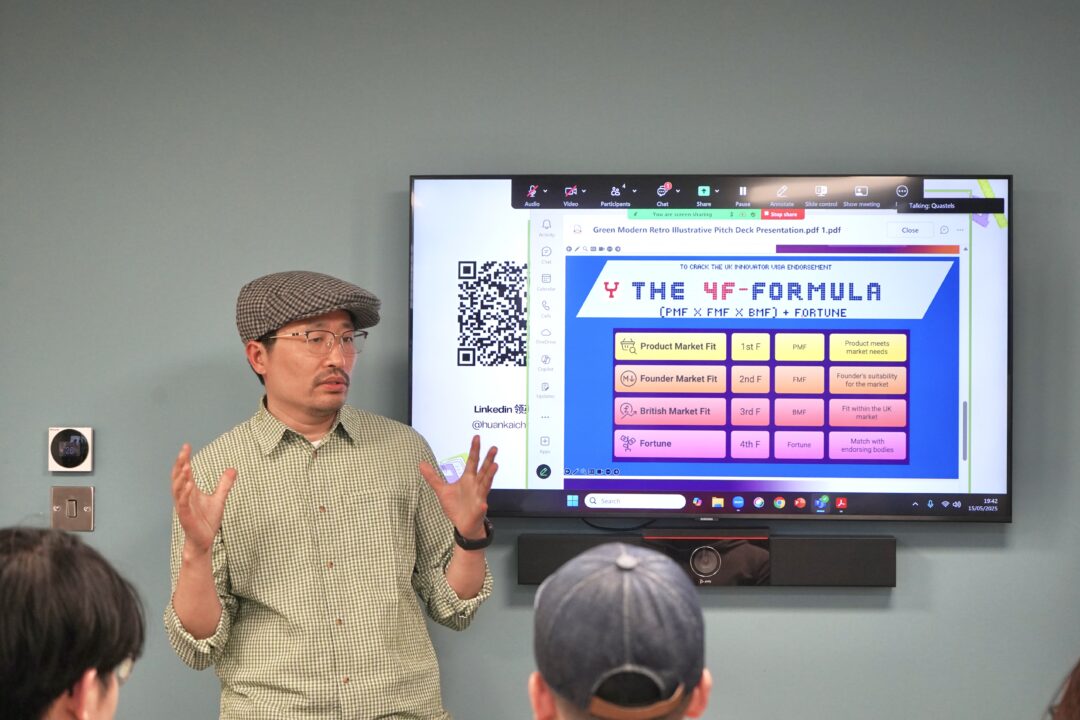

Quastels Hosts Monthly APAC Networking Events in Collaboration with NEXTidal

Quastels is proud to host a series of monthly networking events through its APAC Desk, in collaboration with NEXTidal, a community-driven initiative that connects Chinese entrepreneurs and investors with opportunities in the UK. These event’s reflect our firm’s ongoing commitment to supporting cross-border business ventures and fostering meaningful professional relationships.

Strengthening the APAC-UK Business Bridge

Our monthly networking sessions serve as a dynamic platform for entrepreneurs, founders, and investors to share insights, discuss business strategies, and explore collaborative opportunities. These events are designed to cultivate a supportive ecosystem for Chinese entrepreneurs navigating the UK market, offering a valuable space to connect with like-minded professionals and industry leaders.

Quastels and NEXTidal work closely to ensure each event offers real value to attendees. The format typically includes introductions to both organisations, a spotlight on our APAC Desk’s legal capabilities, and a presentation by a guest speaker, a Chinese entrepreneur or founder who has successfully launched their business in the UK. Following the presentation, guests engage in open networking sessions, creating opportunities for new partnerships, mentorships, and investment discussions.

What is NEXTidal?

NEXTidal is an initiative that brings together entrepreneurs, investors and seasoned professionals to foster innovation and international growth. Their mission is to support both established Chinese brands looking to expand internationally and new start-ups founded by Chinese entrepreneurs in the UK.

Through networking events, strategic partnerships, and curated resources, NEXTidal plays a pivotal role in connecting Chinese-founded businesses with the support systems they need to thrive abroad, from funding opportunities to expert-led advice on navigating local markets.

The Role of Quastels’ APAC Desk

As a trusted legal partner to NEXTidal, Quastels provides end-to-end support to emerging and expanding businesses operating between Asia and the UK. Our APAC Desk, led by legal professionals with deep regional expertise & language capabilities, delivers tailored legal guidance in areas such as market entry strategies, corporate structuring, commercial agreements, employment law, and mergers & acquisitions.

We understand the regulatory and cultural complexities that come with international business expansion. Our team helps clients navigate these challenges with confidence, combining legal acumen with a strategic understanding of the business environment across both regions. Whether it’s structuring a joint venture, drafting cross-border commercial contracts, or ensuring compliance with UK regulatory requirements, we support our clients every step of the way.

A Glimpse Into the Events

The APAC networking events take place at our centrally located Baker Street office in London, with a hybrid option for virtual attendance. This flexible format enables wider participation and facilitates connections across geographies.

Each month, we feature a new guest speaker, an entrepreneur of Chinese origin who is actively building a presence in the UK. These speakers have represented a wide spectrum of industries, including pet care innovation, live music and entertainment, and artificial intelligence solutions. Their stories highlight the creativity, resilience, and ambition that define the modern entrepreneurial journey.

These events don’t just showcase success stories. They also serve as a forum for open dialogues about challenges, lessons learned, and how communities like NEXTidal and legal partners like Quastels can offer meaningful support.

Looking Ahead

As the global business landscape becomes increasingly interconnected, Quastels remains committed to building bridges between regions and empowering entrepreneurs to think beyond borders. Our ongoing collaboration with NEXTidal is more than a professional partnership. It’s a shared vision for fostering innovation, collaboration, and sustainable growth across international markets.

We welcome founders, investors, and professionals who are interested in engaging with the APAC-UK corridor to join us at our upcoming events. Whether you are in the early stages of expanding your business or seeking new connections in the UK market, these sessions are an ideal opportunity to gain insight, forge partnerships, and access specialist legal expertise tailored to your international ambitions.

For more information about our APAC Desk or upcoming events, please contact us either by completing the form below, or emailing thon@quastels.com.

Read More