Latest Posts

The Great Wealth Exodus of 2024

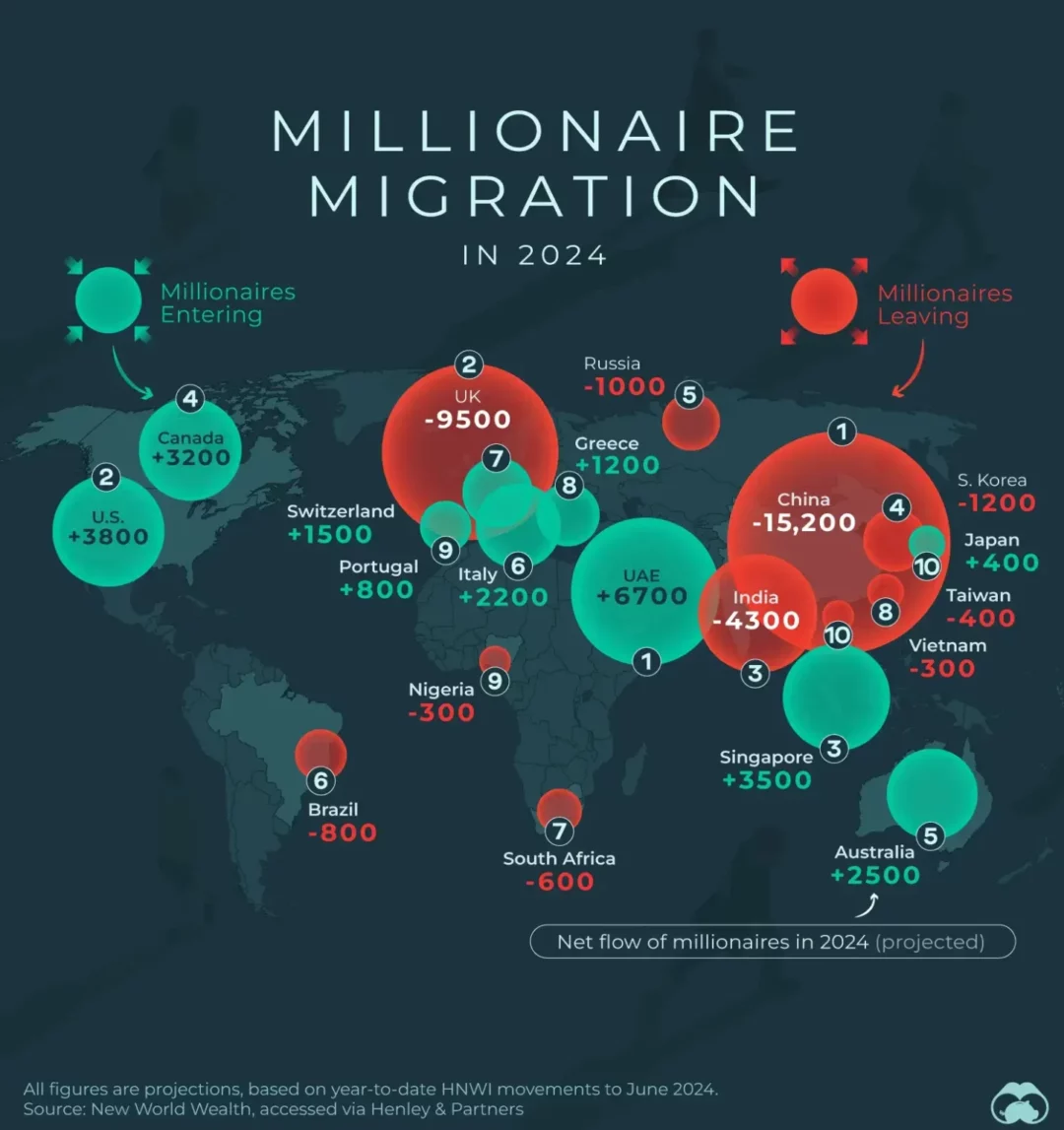

The global wealth landscape is experiencing some earth-shattering shifts in 2024, as revealed by the latest millionaire migration data (see below). Behind this trend, highlighting the significant migration and movement of high-net-worth individuals (HNWIs), is an intriguing insight into the economic and social factors influencing such movement. Concerning for many closer to home and one of the most stand-out aspects of this data is the considerable exodus of wealthy individuals from the UK.

What Is Causing The Exodus?

In short, the UK is projected to see a net loss of 9,500 millionaires in calendar year 2024, making it one of the top countries experiencing an outflow of affluent residents. Several factors appear to contribute to this migration, including:

- Perceived political instability – although arguably few ‘developed’ nations are entirely immune from this currently (noting France and the US to name a few);

- Economic uncertainty post-Brexit;

- High tax rates and the prospect for ever greater tax rises under an incoming Labour Government, noting the proposal to abolish the ‘non-dom’ regime by both the Conservative and Labour Parties; and

- Perhaps more compellingly, the allure of more stable, tax favourable environments in other jurisdictions, such as Italy, UAE and Switzerland.

For example, jurisdictions like the UAE, with a net influx of 6,700 millionaires, and even the US despite being caught up in potential turbulence with the upcoming presidential election, attracting 3,800, are becoming popular destinations due to their perceived favourable tax regimes and economic opportunities.

I’m Thinking of Leaving – What Do I Do?

Whatever the case may be, migration presents many opportunities as well as many potential pitfalls. For anyone considering such a move, it is essential to understand the complexities involved, particularly when it comes to taxes. When leaving, perhaps predictably so, the focus tends to be on the arrival lounge rather than the departure lounge. Put differently, where the grass appears greener, human attention will follow. However, leaving a country without proper tax advice can lead to unexpected liabilities and headaches. Indeed, leaving may not necessarily mean a total severance with no return as, after many years of residence, it is so easy to say goodbye for good.

So, a key part of relocating is understanding the tax implications in both places. In the UK, for instance, the tax system is residence-based, meaning some might still owe UK taxes even after moving abroad. The nuances of double taxation agreements between the UK and the destination country can also impact the fiscally-felt future lying ahead. So, getting comprehensive tax advice isn’t just a good idea—it’s a must.

Tax aside, the relocation of millionaires can impact the economies of both the countries of departure and arrival. In the UK, losing high-net-worth individuals could affect investment levels, job creation, and overall economic dynamism. On the other hand, countries attracting these wealthy migrants stand to gain significantly, with potential boosts in investment, economic activity, and the prime property market.

Some Parting Advice

Put simply, the millionaire migration trend of 2024 highlights the importance of stability, economic opportunity, and favourable tax policies in retaining and attracting HNWIs to various jurisdictions. As the global wealth landscape continues to evolve, understanding these trends will be crucial for navigating the opportunities and challenges ahead. As ever, contact your friendly tax advisor to understand how such moves might impact you.

For private wealth & tax advice and services, please contact Ben Rosen via our contact form below.

The Big Housing Debate: What Are UK Parties Really Promising?

With a shortage of homes, intractable planning laws and an increasing population, the UK’s housing market is a point of contention for those looking to get on the housing ladder and those already on it. For voters this year, it is a big issue.

With that in mind, what are the main parties promising the electorate they are going to do if elected to form a government?

Labour

Starting off with the current favourites to win the general election, Labour have committed in their manifesto to –

- Build 1.5 million new homes, including a preference for housing that offers more affordable rental and ownership schemes.

- Give people who rent their home more rights and stop them being removed without good reason.

- Update the National Policy Planning Framework to restore mandatory housing targets, including for mayoral authorities, and strengthen the presumption of sustainable development for new residential planning applications, particularly on brownfield urban sites.

- Take a more strategic approach to greenbelt designation and release more land for homes to be built on. New development requirements will at the same time have to focus on benefitting communities and nature.

- Increase non-resident Stamp Duty Land Tax surcharge from 2% to 3% and use the income generated from that to fund additional planning officers for development implementation, including for the development of new towns.

- Make it easier for authorities to enforce compulsory land purchase, and reduce payouts to landowners, basing compensation on actual value rather than based on the prospect of planning permission.

- Make it more difficult and expensive to purchase social housing.

- Require developers to prioritise selling new homes to first-time buyers and locals rather than overseas buyers.

- Introduce a mortgage guarantee scheme to support first-time buyers.

- Ban new leasehold flats and promote commonhold as the default tenure, as well as “tackling unregulated and unaffordable ground rent charges.” It also talks about ending the “injustice of leasehold private housing estates and unfair maintenance costs”, as well as making it easier and cheaper for lease extensions and granting more rights to manage.

CONSERVATIVES

The current party in power has committed to the following if re-elected –

- Build 1.6 million new homes, creating more flexibility by abolishing planning laws previously enforced by the EU and prioritising building on brownfield land in urban areas, whilst protecting greenbelt land.

- Focus on raising density levels in inner London to those of European cities like Paris and Barcelona and focusing on regeneration sites in Euston, Old Oak Common and Thamesmead. Outside London the focus on redevelopment will be towards the cities of Leeds, Liverpool and York.

- Require councils to set land aside for local and smaller builders as well as enforcing less planning requirements on them.

- Require local authorities to use infrastructure levies paid to them by developers to improve the local areas, such as by delivering road improvements and GP surgeries to support the new homes.

- Renew the affordable homes programme so more people can get on the housing ladder and make permanent abolishing Stamp Duty for homes up to £425k for 1st time buyers. A new Help to Buy scheme will be introduced to provide up to 20% of the cost towards a new home, requiring buyers to only have a 5% deposit (funded in part by contributions from residential developers).

- introduce a “three strikes and you’re out” policy for anti-social behaviour from social housing tenants.

- Retain the number of current council tax bands, and see where cuts can be made to costs families are making.

- Retain the rule of people not paying Capital Gains Tax on their main home, retain rules permitting people to purchase their own social housing and retain current Stamp Duty levels.

- Provide a 2 year Capital Gains Tax relief to Landlords who sell their property to their existing tenants.

- Cap ground rents at £250 and phase in a reduction to a peppercorn (ie. zero pounds).

- Make it more difficult to end a lease through forfeiture of long leases and outlaw evictions of private tenants without good reason.

- Give councils the powers to limit holiday lets.

Liberal Democrats

The Lib Dem manifesto has promised to

- Build 380,000 new homes including 150,000 social homes a year through “new garden cities” and encouraing community-led development.

- Banno-fault evictions and make 3 years the default for tenancies, as well as creating a national register of licenced landlords.

- Give local authorities the right to end people’s ability to purchase their social housing.

- Permit local councils to purchase land at current value for redevelopment rather than inflated planning-added-value rates.

- Ensure new development has better flooding protections where relevant.

- Introduce‘use-it-or-lose-it’ planning permission for developers to encourage them to build, rather than sit on empty land.

- Introduce a rent to earn scheme whereby rental payments go towards ownership in the final equity of property.

- Make homes warmer and cheaper to heat with a ten-year emergency upgrade programme, and ensure that all new homes are zero-carbon.

- Remove dangerous cladding from all buildings, while ensuring that leaseholders do not have to pay a penny towards it.

Reform

The newest “big” party has committed to

- Fast track brownfield site development applications and provide more flexibility to developers who wish to undertake large residential developments.

- Require developers to prioritise local buyers.

- Enable landlords to deduct finance costs and mortgage interest from tax on rental income to encourage smaller landlords into the market.

- Incentivise new construction technology to speed up home building.

- Require potential leasehold or freehold charges to be made clear to new home purchasers.

- Reduce costs to extend leases and for leaseholders to buy their freehold.

Greens

The Greens have committed to

- Require local authorities to spread small developments across their areas.

- Require all new developments to be accompanied by the extra investment needed in local health, transport and other services.

- Ensure that all new homes include solar panels and heat pumps, where appropriate.

- Invest:

- £29bn to insulate homes to an EPC B standard or above.

- £4bn to insulate other buildings to a high standard

- £9bn for low-carbon heating systems (e.g. heat pumps) for homes and other buildings

- Provide 150,000 new social homes and end the private right to buy scheme.

- Introduce rent controls for local authorities to manage.

- End no-fault evictions and introduce a tenants’ right to demand energy efficiency improvements.

- Create residential tenancy boards to provide an informal, cheap and speedy forum for resolving disputes before they reach a tribunal.

This article hasn’t touched on how realistic any of these policies actually are (some of them may strike you as particularly ambitious!). Their desirability will be decided by the Great British public on the 4 July!

To discuss any of the points raised in this article, please contact Josh Fraser, or fill in the below form.

The 2024 Election and Its Impact on UK Commercial Property Law: Key Insights for Investors, Occupiers, and Developers

With the 2024 General Election approaching, the UK real estate sector will be evaluating the promises of the major political parties and their potential impact on property law. We examine the manifestos of the main parties, focusing particularly on the Conservatives and Labour.

Conservative Party Manifesto

Leasehold and Freehold Reform:

The Conservatives have passed the Freehold and Leasehold Reform Bill, introducing major changes to long residential leases and banning new leasehold houses, except for retirement housing. They propose capping ground rents at £250 per annum, reducing to a peppercorn over time.

No Fault Evictions:

The Conservatives plan to reintroduce the Renters Reform Bill, abolishing section 21 ‘no fault’ evictions and enabling landlords to evict tenants guilty of anti-social behaviour.

Building Safety:

The Conservatives support ongoing developer-funded remediation programs for mid-and high-rise buildings. They also advocate for simplifying planning processes to encourage housing development, especially for older people, and using the new infrastructure levy to support local services.

Energy Efficiency and Housing:

The Conservatives aim to abolish EU ‘nutrient neutrality’ rules to unlock 100,000 new homes. They would make permanent the higher stamp duty threshold for first-time buyers at £425,000, renew the affordable homes program, and propose a new Help to Buy scheme.

Planning:

The Conservatives focus on enhancing the role of statutory consultees in the planning system and amending laws to prevent judicial reviews from delaying infrastructure projects. They also commit to protecting the green belt from uncontrolled development.

Climate Change:

The Conservative party pledges to fund an energy efficiency voucher scheme for households and implement a new import carbon pricing mechanism by 2027. They guarantee a parliamentary vote on the net zero pathway, aiming to achieve net zero by 2050.

Key Pledges:

- Pass a Renters Reform Bill to abolish Section 21 ‘no fault’ evictions.

- Strengthen grounds for landlords to evict tenants guilty of anti-social behaviour.

- Provide councils with powers to manage holiday lets.

- Introduce a two-year temporary Capital Gains Tax relief for landlords who sell to tenants.

- Maintain Private Residence Relief to protect homes from Capital Gains Tax.

- No increases to residential stamp duty rates, making permanent the higher first-time buyer threshold.

Labour Party Manifesto

Leasehold and Freehold Reform:

Labour commits to significant leasehold reforms, including banning new leasehold flats and ensuring commonhold becomes the default tenure. They plan to enact the Law Commission proposals on leasehold enfranchisement, right to manage, and commonhold.

No Fault Evictions:

Labour pledges to abolish section 21 ‘no fault’ evictions, ensuring landlords provide specific reasons for ending tenancies.

Building Safety:

Labour proposes stronger measures to protect leaseholders from remediation costs and aims to accelerate cladding remediation.

Energy Efficiency and Housing:

Labour plans to invest £6.6 billion in home energy efficiency, aiming for private rented sector homes to meet minimum standards by 2030. They also intend to enhance the affordable homes program and strengthen planning obligations to ensure new developments include affordable housing.

Planning:

Labour promises to update the national policy planning framework and restore mandatory household targets. They propose additional funding for planning officers and reforms to compulsory purchase compensation rules.

Climate Change:

Labour emphasizes climate change, promising additional investments to improve home energy efficiency and collaborate with the private sector to finance home upgrades and low carbon heating.

Key Pledges:

- Immediately abolish Section 21 ‘no fault’ evictions.

- Empower renters to challenge unreasonable rent increases.

- Extend ‘Awaab’s Law’ to the private sector, requiring landlords to fix health hazards promptly.

- Increase stamp duty for non-UK residents.

- Build 1.5 million homes and create new towns across England.

Conclusion

The party manifestos demonstrate how different political administrations might impact the real estate market. A change in government will likely bring significant change to property law, particularly if that government has a large majority. However; as we have learnt with the recent Building Safety Act and Renters Reform Bill, the devil will be in the detail. When legislation is rushed through and poorly drafted it can create the negative unintended consequence of market uncertainty.

To discuss any of the points raised in this article, please contact Mark Cornelius or fill in the form below.