Latest Posts

The Winter Budget is Coming: Speculation, speculation and more speculation

With the Autumn (although arguably Winter) Budget confirmed for 26 November 2025 and with the Chancellor Rachel Reeves under ever-growing pressure to address a significant fiscal gap (estimated at around £20–£40 billion), speculation is growing unabatedly and somewhat exhaustingly! While Labour maintains its manifesto pledge not to raise income tax, VAT, or National Insurance on working people the Government appears (through ongoing media speculation) to have inheritance and property in its crosshairs to plug the shortfall.

Potential changes on the horizon

So, given the constant fiscal newsfeed and the potential urgency, we have waded through the media speculation to present the key potential changes to look out for in the private client space:

Inheritance Tax (IHT)

In this Budget, we may see an announcement of a lifetime cap on tax free gifts, limiting the total amount that can be passed on exempt from IHT, even if the donor survives seven years. Possibly, instead of or in addition to this, we may see an extension of the so-called ‘seven-year rule’ to ten years, which would align conveniently with the latest IHT changes introduced on 6 April for Long-Term Residents.

Stamp Duty Land Tax (SDLT) Overhaul and Mansion Tax

Reports in various media outlets suggest a radical overhaul of SDLT, including:

- Replacing upfront SDLT with a proportional ‘national property tax’ on homes over £500,000; and

- Introducing a ‘mansion tax’ or wealth-based levy on high-value properties (possibly above £1.5 million or even £2 million).

How this applies to non-residents and owners of additional properties remains to be seen, but we would expect some form of surcharge to remain to dissuade overseas buyers from accumulating too much UK property.

Capital Gains Tax (CGT) on Primary Residences

This may shock many but the exemption on gains from selling primary residences could be removed for high-value properties, with speculation that this would apply to properties valued over £1.5 million with CGT kicking in at the excess of this.

National Insurance on Rental Income

The Government is considering subjecting private landlords’ rental income to NIC (potentially an 8% lev) affecting individual and partnership income.

What can be done?

Without wanting to dive into complex prose not turn this into an opinion piece, I will keep this punchy in the interests of time.

The key takeaways are as follows:

- Review assets in the next two months and establish (with the assistance of both lawyers and financial advisors) what assets can be gifted; and

- Consider any upcoming property transactions and establish whether to accelerate or delay pending the outcome of the Winter Budget and further clarity on SDLT reforms.

If you have any queries relating to Inheritance Tax and gifting, please contact Ben Rosen of Quastels LLP.

Read More

Failure to Prevent Fraud: A Turning Point in Corporate Accountability

The new failure to prevent fraud offence (“FTPF”) under the Economic Crime and Transparency Act 2023 (“the Act”) is now in force (1 September 2025) for large organisations. It is vital that companies consider if they fall within the reach of the new offence.

With increasing public concern of rising economic crime and corporate malpractice, the UK government introduced a significant reform to corporate criminal liability. This new offence mirrors similar offences already in place for bribery (under the Bribery Act 2010) and tax evasion (under the Criminal Finances Act 2017).

Scope and Accountability

The offence applies to large organisations, defined as those meeting at least two of the following criteria:

- More than £36 million in turnover

- More than £18 million in total assets

- More than 250 employees

Section 199(13) of the Act says the offence applies to organisations incorporated or formed by any means which includes under the Companies Act 2006, The Limited Liability Partnerships Act 2000, Royal Charter, Statute (for example the NHS Trust). Current guidance suggests that the concept of “large organisations” is intentionally broad to cover the wider “group” of companies. Organisations does not mean bodies corporate, as such partnerships and Limited Partnerships fall within scope.

Most crucial is the extra-territorial reach of the Act. The offence applies to bodies incorporated and partnerships formed outside the UK but with a UK nexus. UK nexus means that:

- one of the acts that was part of the underlying fraud took place in the UK; or

- the gain or loss took place in the UK.

Whilst the intention from policy makers is that SMEs are not unduly burdened by the new FTPF offence, it should be noted that this is a policy priority. SMEs should remain abreast of regulations as:

(i) they could become within scope, either by virtue of existing legislation changing, or the company’s organic growth, and

(ii) Government guidance clearly indicated that irrespective of whether a company falls within scope, this should be considered industry best practice.

What Constitutes the Offence?

A company will be guilty of the offence if: (a) an “associated person” (e.g. an employee, agent, subsidiary) commits a fraud offence intending to benefit the organisation or another person to whom services are provided on behalf of the organisation, and (b) the organisation failed to prevent the fraud.

Importantly there does not need to be any actual benefit, merely the intention on behalf of the associated person to benefit.

“Associated Person” is interpreted broadly, including employees, agents, contractors, and even some subsidiaries. The intention is to ensure that companies are responsible for fraud committed by individuals who represent them in a relevant capacity.

If the organisation is found to have committed the offence, the sanction is an unlimited fine.

Fraud Offences Covered

The offence encompasses a wide range of economic crimes, including:

- Fraud by false representation (s.2 Fraud Act 2006)

- Fraud by abuse of position (s.4 Fraud Act 2006)

- Fraud by failing to disclose information (s.3 Fraud Act 2006)

- False accounting (s.17 Fraud Act 2006)

- Participating in a fraudulent business (s.9 Fraud Act 2006 and s.993 Companies Act 2006)

- Cheating the public revenue (The Theft Act 1968)

“Reasonable Procedures” Defence

The only defence available is that the organisation had “reasonable procedures” in place to prevent fraud. This is akin to the “adequate procedures” defence under the Bribery Act.

The Government has released some guidance for reasonable fraud prevention procedures and include:

- Top level commitment – responsibility for prevention of fraud should be placed at senior governance level so directors, partners, senior management to ensure a clear governance framework across the entire organisation.

- Risk assessments – these are dynamic procedures and as such they should be regularly documented and reviewed.

- Proportionate risk-based fraud prevention procedures – aim should be to reduce opportunities for fraud which may arise within the companies operating structures.

- Due diligence – appropriate checks in place such as external identity verification, dual approval process on certain transactions.

- Communication – procedures and policies should be effectively communicated through the company through active training.

- Monitoring and review – ongoing monitoring should be in place which actively detects incidents of fraud.

The Government has made it clear that many companies will have adequate procedures in place and that it is not necessary to duplicate work, however simply relying on pre-existing procedures will not mean those procedures are adequate unless they have been reviewed.

Why This Matters

The new offence is significant for several reasons:

- Increased Accountability: Companies can no longer shield themselves behind complex structures or claim ignorance of employee’s actions.

- Shift in Compliance Culture: Like the Bribery Act before it, the Failure to Prevent Fraud offence is expected to drive cultural change, embedding anti-fraud measures into corporate governance.

- Enforcement Pressure: Whilst previous criticised for failing to pursue corporate crime, agencies such as the Serious Fraud Office (SFO) and Crown Prosecution Service (CPS) will be more likely investigate suspicious or concerning activity.

What Should Companies Do Now?

Companies should act now to ensure compliance. Directors, Partners and Senior Managers should understand where and how your organisation might be vulnerable to fraud. Ensure internal procedures are up to date and robust enough to detect and prevent fraudulent activity.

Government guidance has made it clear that it is not sufficient to rely on the procedures that already exist as a defence, if these procedures are not adequate. As such checking existing procedures should be the first priority. This may require external advisors to benchmark and update your policies.

The new offence sends a clear message: preventing fraud is not optional. Companies must take responsibility for the actions of those who represent them and put in place robust, reasonable procedures to stop economic crime in its tracks. In doing so, they not only comply with the law but also strengthen their ethical foundation.

If you require any assistance with reviewing and updating your procedures to ensure compliance, please contact Max Sherrard (msherrard@quastels.com).

Read More

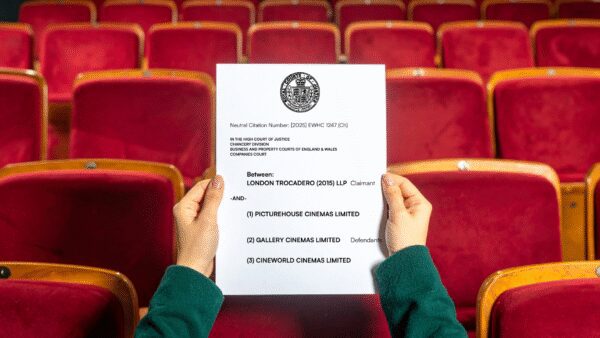

Landmark Decision in Trocadero v Picturehouse

A recent ruling in Trocadero (London) Ltd v Picturehouse Cinemas Ltd & others has clarified the scope of the covenant to pay insurance rent in commercial leases with particular reference to landlord’s commission. At Quastels, we are closely following the implications of this judgment for our clients involved in commercial property leases. The decision carries significance for both landlords and tenants with potential ramifications both in terms of future drafting of leases and retrospective claims from tenants.

Background

The dispute arose out of the Landlord’s (Trocadero (London) Ltd) claim against its tenants (Picturehouse Cinemas and others), for failure to pay the annual rent and insurance rent, albeit, during COVID-19-induced closures. The Landlord’s claim for recovery of rent arrears was successful, however, the tenants brought a counterclaim questioning the level of insurance rent payable under the terms of the lease, specifically the recoverability of the Landlord’s commission. As would be expected in the vast majority of commercial leases of part, the landlord had an obligation to insure the centre in which the units were located and the tenants were obligated to pay the ‘premium’ and associated costs payable by the landlord in keeping the building insured.

In this case, the ‘premium’ charged to the Tenant, by way of insurance rent, was made up of the following:

- The actual cost of insuring the building (the net premium);

- The insurance broker’s commission; and

- The Landlord’s commission, to be recovered from the Tenant for the benefit of the Landlord.

It is worth noting that on occasions, the Landlord’s commission amounted to over 50% of the premium. The landlord’s commission was entirely optional and obtained at the Landlord’s broker’s request based on a commission sharing arrangement – with the broker retaining an amount and repaying the remainder to the landlord.

Judgment

Ultimately, the court did not find that the Landlord’s commission was contractually payable by the Tenant under the terms of the lease and, importantly, ordered that sums received from the Tenant on account of the Landlord’s commission element of the insurance rent were to be repaid to the Tenant.

What was material to the Court was that the Landlord’s commission was optional, therefore, hypothetically speaking, even if the Landlord’s commission was deemed to be payable, it would not satisfy the criteria of being payable for keeping the building insured, but rather for “providing the Landlord with an opportunity to profit at the Tenant’s expense” as Justice Richards explained. Justice Richards further commented that “the costs in question are in the nature of overheads or costs of the Landlord’s letting business which is to be paid out of the receipt of rent”, indicating that any administrative costs in Landlords arranging buildings insurance should form part of their commercial considerations or financial analysis before letting a premises.

What does this mean for you as a Landlord or a Tenant?

There is a general consensus amongst legal professionals that this ruling may act as a catalyst for commercial tenants to look more closely into any embedded commissions that could be hidden within their insurance rents, in the hopes of seeking restitutionary remedies in respect of any payments previously made.

However, landlord commission structures are commonplace in commercial buildings insurance set-ups (albeit usually at a much lower percentage than as seen in this case), and such remedies would only be afforded to tenants in the absence of clear insurance provisions in the lease. There are various conditions which must be satisfied in order for a tenant to have legitimate grounds for such a claim. It is therefore crucial that tenants seek legal advice on (1) the scope of any insurance rent, before committing to a lease and (2) provisions in existing leases if tenants consider they may have a potential claim for overpaid commission.

In terms of point (2) and potential claims, tenants should act quickly given that, as a general rule (with some exceptions), a claim under restitution is time limited to six years.

Landlords should be cautious before adopting an all-encompassing approach to cost recovery as it is now clear that the courts will be unlikely to favour the landlord and permit the recovery of landlords’ commissions where this is not expressly stated in the lease. This calls for Solicitors to work collaboratively with their landlord clients to avoid any ambiguity in the recoverability of all elements of insurance rent.

Conclusion

Trocadero v Picturehouse provides us with clear guidance that the courts expect landlords abd tenants to negotiate lease agreements critically, to avoid any disparity in the respective parties’ financial obligations. Going forwards, the standard commission fee being charged to tenants could be subject to challenge in new leases and could result in numerous successful claims for previous such payments to be recovered.

Our expert Commercial Real Estate and Property Dispute Resolution departments are here to provide both tenants and landlords with bespoke advice in relation to both the interpretation of existing leases and the possibility of claims being made for previous overpayments and the drafting of insurance provisions in future leases.

Read More